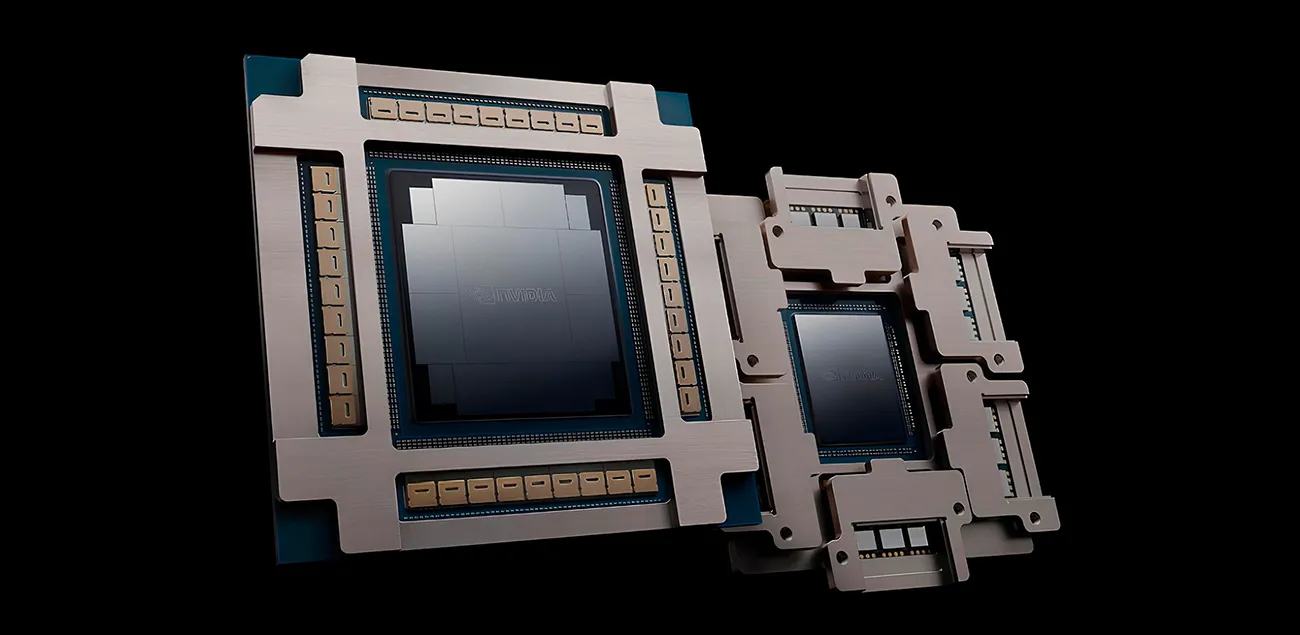

Nvidia, AI-chip maker, and Taiwan Semiconductor Manufacturing, contract foundry, have doubled down on copper interconnects even as the industry touts silicon photonics, with chief executive Jensen Huang saying optical I/O remains “several years away” from broad deployment and that systems should “stay with copper for as long as we can.” The stance comes as Nvidia pilots photonics inside new network switches with TSMC, but keeps copper between GPUs and boards to meet near-term reliability and cost targets.

Silicon photonics creeps in—at the switch, not the socket

Nvidia’s roadmap brings optics into the data-center fabric first. Co-packaged optics—where lasers and photonic ICs are integrated alongside switch silicon—are slated for Quantum-X InfiniBand and Spectrum-X Ethernet platforms, cutting power and eliminating pluggable transceivers in top-of-rack gear. But Huang has cautioned that optical chiplets are not yet robust enough for GPU packages; initial deployments will remain confined to switches shipping through 2025–26. Intel, an early photonics proponent, has likewise kept its optical-interconnect chiplet at trial stage with select customers.

Why copper still wins (for now)

Copper’s advantages are ubiquity, cost, and proven reliability across short-reach links on boards and trays. The physics favor optics as rack-scale bandwidths soar, but packaging yield, laser lifetime, thermal management and supply-chain maturity remain hurdles before mass optical I/O moves onto accelerators. Peer-reviewed roadmaps point to continued materials and packaging challenges before foundry-scale, CMOS-compatible photonics can generalize beyond networking.

Market impact: AI build-out pulls on copper—hard

Keeping near-socket links on copper is not just a design choice; it reverberates up the metals chain. BloombergNEF estimates AI data centers will consume an average ~400,000 tonnes of copper a year over the next decade, peaking near 572,000 tonnes in 2028 and locking up a cumulative 4.3 million tonnes by 2035—contributing to a potential 6-million-tonne market deficit. LME three-month copper has hovered around $9,600–$9,800/t in recent sessions as traders weigh AI and grid demand against macro volatility.

Technology trajectory and competitive landscape

Nvidia’s near-term network play is two-track: Spectrum-X, a full-stack Ethernet fabric optimized for AI throughput, and Quantum-X InfiniBand, both moving toward co-packaged photonics to curb energy and space. Rival chipmakers are positioning: AMD has bolstered its optical ambitions with acquisitions, while switch and optics vendors from Broadcom to Cisco are racing on co-packaged designs that could reshape transceiver demand. The direction of travel is clear—more light, less copper over distance—but Huang’s message is that CPUs/GPUs will cross that Rubicon only when photonics proves cost-reliable at package scale.

Company Background and Market Context

Nvidia dominates AI accelerators and has expanded into networking to relieve system bottlenecks as GPU counts per cluster explode. Partner TSMC is developing silicon-photonics process flows aligned to Nvidia’s packaging timelines, though both companies have flagged a multi-year horizon before broad optical I/O on compute dies. Intel, an early mover, showcased an optical-compute-interconnect chiplet in 2024 but, like Nvidia, has focused near-term optics on switching rather than processor packages. Industry research underscores the need for progress in lasers, modulators, and high-volume assembly to hit mass adoption.

Copper remains the workhorse metal of digital infrastructure: unmatched conductivity and ductility make it indispensable for power delivery, busbars and short-reach data links. Prices have eased from spring peaks but stay historically elevated as electrification and AI data-center builds overlap; any delay in optical I/O adoption extends copper’s demand runway, particularly inside racks and between servers.