The International Copper Study Group, a global intergovernmental organization monitoring copper markets, reported that worldwide refined copper surplus declined marginally to 233,000 tonnes during the first four months of 2025 compared to 236,000 tonnes in the corresponding period of 2024. Global refined copper production increased 3.2% year-over-year to 9.4 million tonnes while consumption expanded 3.3% to 9.2 million tonnes, indicating balanced market dynamics despite ongoing supply chain adjustments across major producing regions.

Production Gains Led by Peru and Democratic Republic of Congo

Mine production increases concentrated in key Latin American and African operations, with Peru recording 5% year-over-year growth driven by expanded output at Las Bambas, Quellaveco, and Toromocho facilities. The Democratic Republic of Congo achieved approximately 8% production growth primarily through capacity expansion at the Kamoa-Kakula copper complex, which reached commercial production in 2021 and continues ramping toward full operational capacity.

Production gains from these operations partially offset declines in Canada and Indonesia, where operational challenges and resource depletion at mature mines constrained output. Canadian copper mine production has faced headwinds from aging infrastructure at several major operations, while Indonesian production reflects ongoing transitions in mining concessions and environmental compliance requirements.

Chinese Demand Drives Global Consumption Patterns

Chinese apparent copper demand expanded approximately 6% during the four-month period, maintaining the country’s dominant position with 58% of global copper consumption. This growth reflects continued infrastructure development, renewable energy installations, and electric vehicle manufacturing expansion across China’s industrial sectors. The country’s copper consumption reached an estimated 5.34 million tonnes during the period, supporting global market balance despite modest surplus conditions.

Copper demand outside China remained relatively unchanged, indicating regional variations in economic activity and industrial production. European and North American consumption patterns showed stability amid ongoing transitions toward electrification and renewable energy infrastructure, while emerging markets demonstrated mixed performance based on local economic conditions and development priorities.

Market Dynamics Reflect Infrastructure Investment Trends

The stable surplus conditions occur against a backdrop of accelerating global electrification initiatives and infrastructure modernization programs. Copper’s essential role in electrical systems, renewable energy installations, and electric vehicle production continues driving long-term demand projections, despite short-term market fluctuations. Average London Metal Exchange copper prices traded between $8,500-9,200 per tonne during the first quarter of 2025, reflecting balanced supply-demand fundamentals.

Global refined copper production capacity utilization remained high across major producing regions, with smelters in China, Chile, and Japan operating near optimal levels. The refined copper market benefits from integrated operations where mining companies control both extraction and processing, providing supply chain stability and cost optimization opportunities.

Regional Production Shifts Reshape Global Supply Chains

The production increases in Peru and Democratic Republic of Congo highlight ongoing geographical shifts in global copper supply chains. Peru’s position as the world’s second-largest copper producer strengthened through continued investment in existing operations and development of new deposits in the Andes Mountains. The country’s copper output reached approximately 2.8 million tonnes annually, supported by favorable geological conditions and established mining infrastructure.

Democratic Republic of Congo’s emergence as a major copper producer reflects significant foreign investment in mining infrastructure and processing capabilities. The Kamoa-Kakula complex, operated by Ivanhoe Mines in partnership with Zijin Mining Group, represents one of the world’s highest-grade copper discoveries and continues expanding production capacity toward projected annual output exceeding 800,000 tonnes.

Company Background and Market Context

The International Copper Study Group operates as an intergovernmental organization established in 1992 to monitor global copper market developments and provide statistical analysis to member countries and industry participants. The organization’s membership includes major copper-producing and consuming nations, providing comprehensive market oversight and data collection capabilities across the global copper value chain.

Major copper mining companies benefiting from current market conditions include Freeport-McMoRan, Southern Copper Corporation, and Glencore, which operate large-scale integrated mining and processing operations. Chinese copper smelters including Jiangxi Copper Company and Tongling Nonferrous Metals Group maintain significant refining capacity, processing both domestic and imported copper concentrates to meet growing industrial demand.

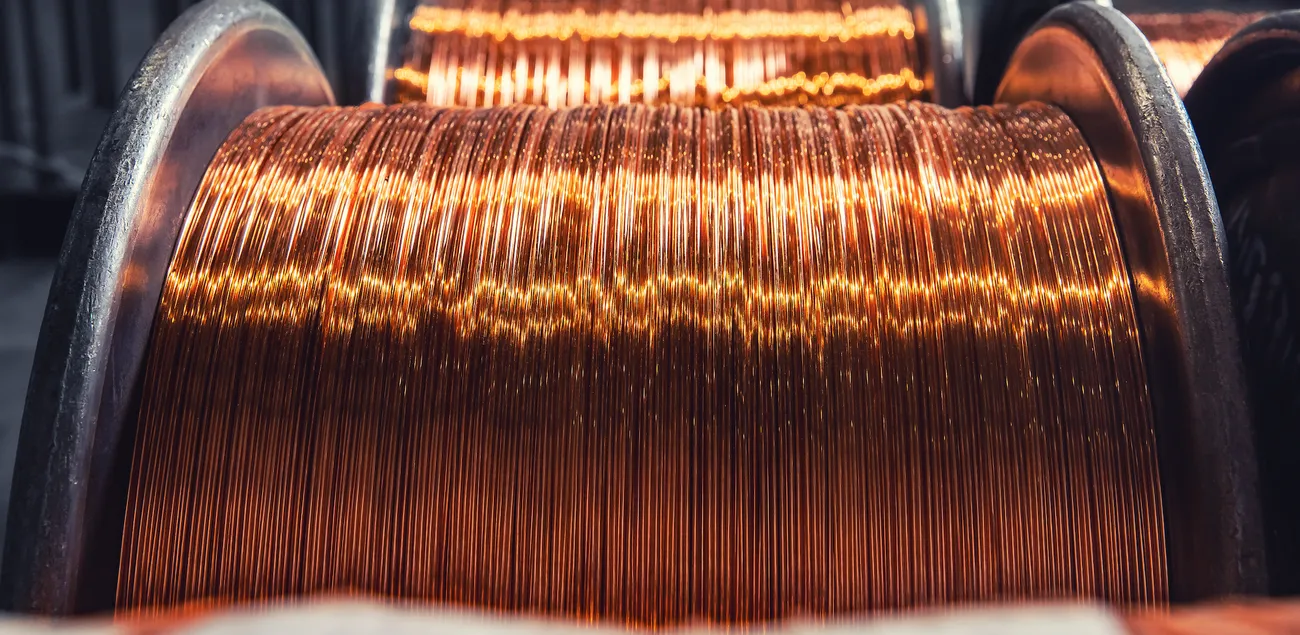

Copper serves as an essential industrial metal for electrical applications, construction, transportation, and renewable energy systems. The metal’s superior electrical conductivity and corrosion resistance make it indispensable for power transmission, telecommunications infrastructure, and electric vehicle manufacturing. Global copper reserves concentrate in Chile, Peru, Australia, and the United States, while recycling provides approximately 35% of global copper supply through scrap metal recovery and processing operations.