The Global Zinc Market Enters an Era of Surplus

The global zinc market is poised for a surplus of 270,000 tonnes in 2025, following a deficit of 184,000 tonnes in 2024. This surplus is expected to exert downward pressure on zinc prices, which BMI forecasts will decline by 5.8% in 2025 to an average of $2,812 per tonne, compared to the 2024 average.

Global zinc production in 2024 fell by 0.7% to 13.8 million tonnes due to a shortage of concentrates and economic challenges in several countries, which constrained zinc consumption. However, production is anticipated to rise by 5.1% in 2025, reaching 14.5 million tonnes, further contributing to the surplus.

Zinc consumption grew by 2.2% in 2024 and is projected to increase by another 1.7% in 2025. The Chinese construction sector, responsible for about 50% of global zinc consumption, remains a key driver despite ongoing challenges. Additionally, India’s increased infrastructure spending is expected to bolster demand.

Looking ahead, BMI predicts a prolonged zinc surplus in the global market through 2033, peaking in 2027 with an excess of 578,000 tonnes. By 2028, average zinc prices are projected to fall to $2,700 per tonne, significantly below the 2022 average of $3,440 per tonne. However, the growth of renewable energy and clean transportation in the US, EU, and China is anticipated to drive demand for zinc in electric vehicle manufacturing and corrosion protection for solar panels and wind turbine components.

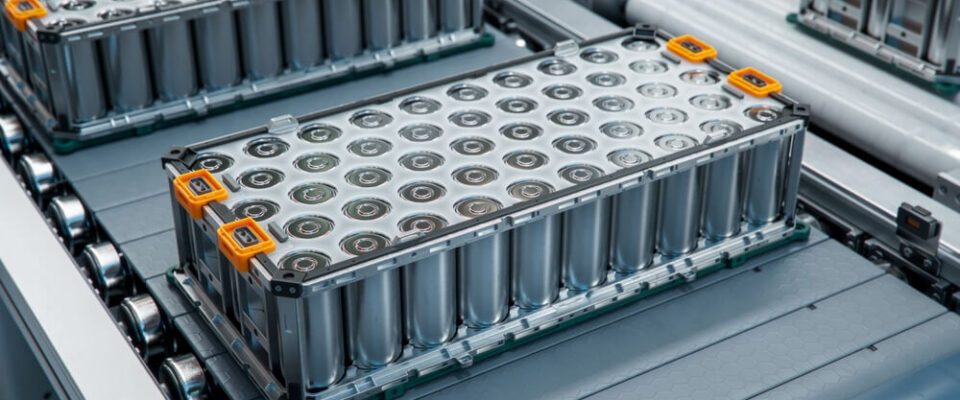

China's Potential Impact on the Electric Vehicle Market

China is considering new export restrictions on technologies critical to lithium-ion battery production. This follows the Ministry of Commerce’s late-2024 decision to ban exports of gallium, germanium, and antimony to the US—materials essential for electronics and munitions production. The proposed measures include restrictions on battery cathode production methods and the extraction of lithium and gallium from minerals.

The Ministry of Commerce is consulting with stakeholders and aims to finalize these restrictions by the end of January 2025. If approved, export licenses will be required for these technologies. Such measures could solidify China’s dominance in global lithium-ion battery supply chains, increasing the dependence of electric vehicle and energy storage companies worldwide on Chinese exports. This strategic positioning could reshape the global market in favor of China.

Recovery of the London Metal Exchange from the Nickel Crisis

The London Metal Exchange (LME) saw a resurgence in 2024, recording its highest trading volumes in a decade. Average daily transactions increased by 18.2% year-on-year to nearly 665,000 lots, with nickel trading surging by 58.8%.

This recovery follows the nickel crisis of March 2022, when prices spiked to $100,000 per tonne amid speculation and geopolitical tensions. While the LME’s intervention prevented further escalation, it also drew criticism and led to the exit of several major players.

In 2024, metal stocks in LME-certified warehouses rose to 2.2 million tonnes, enhancing opportunities for arbitrage, particularly in zinc and aluminum. Renewed interest in non-ferrous metals, driven partly by the renewable energy sector, also fueled trading activity. For instance, September 2024 saw record long positions in tin contracts, while copper trading surged in the first half of the year before slowing due to a strengthening US dollar.

However, the LME faces mounting competition from other exchanges. The Shanghai Futures Exchange has introduced new contracts for alumina, tin, and nickel, while the CME Group and Abaxx Commodity Exchange are expanding offerings in lithium hydroxide, cobalt, and nickel sulfate. This growing competition underscores the evolving dynamics of global metals trading.

Cobalt Market Faces Supply Challenges Amid Rising Demand

Cobalt demand is expected to grow significantly, driven by its critical role in electric vehicle batteries and other applications. The International Energy Agency projects global cobalt consumption to increase from 213,000 tonnes in 2023 to 344,000 tonnes by 2030 and 454,000 tonnes by 2040. However, a potential cobalt shortage looms by 2035 unless over 17 new mines are operational by 2030.

Despite favorable demand forecasts, cobalt prices are under pressure due to surplus supply. Fastmarkets estimates a surplus of 21,000 tonnes in 2025, slightly lower than the 25,000-tonne surplus in 2024. The surplus stems from cobalt’s status as a byproduct of copper and nickel mining, with increased production of these metals adding to cobalt supply.

In 2025, changes in battery chemistry are expected to influence cobalt demand. The growing adoption of lithium-iron-phosphate batteries, particularly in China, is slowing demand for cobalt compounds. These batteries, favored for mid- to low-end electric vehicles, offer cost and durability advantages despite lower energy density.

Compounding this situation are policy shifts in the US. Former President Donald Trump’s announcement to reverse Joe Biden’s 2021 executive order on electric vehicle targets and funding for charging infrastructure could dampen demand for cobalt in the American market.

China Sets Records in Copper Production and Imports

China’s copper imports and production reached new highs in 2024. Copper concentrate imports increased by 2.1% to 28.11 million tonnes, while imports of pure copper and copper products rose by 3.27% to 5.68 million tonnes. December 2024 saw imports of copper concentrate and semi-finished products reach a 13-month peak.

Chinese copper cathode production also hit a record 12.1 million tonnes in 2024, with December output reaching 1.1 million tonnes. This growth reflects improved operational efficiency, with no major smelter shutdowns for maintenance during the month and newly commissioned facilities ramping up production.

However, copper prices declined globally and domestically in December due to a strengthening US dollar. Copper stocks on the Shanghai Futures Exchange rose to 83,200 tonnes in early January 2025, a 17.3% increase from the 10-month low recorded in December 2024. Despite a seasonal slowdown expected during the Chinese New Year, January’s output is likely to surpass the same period last year.