Rio Tinto and Indium Corporation Progress with Gallium Project in Canada

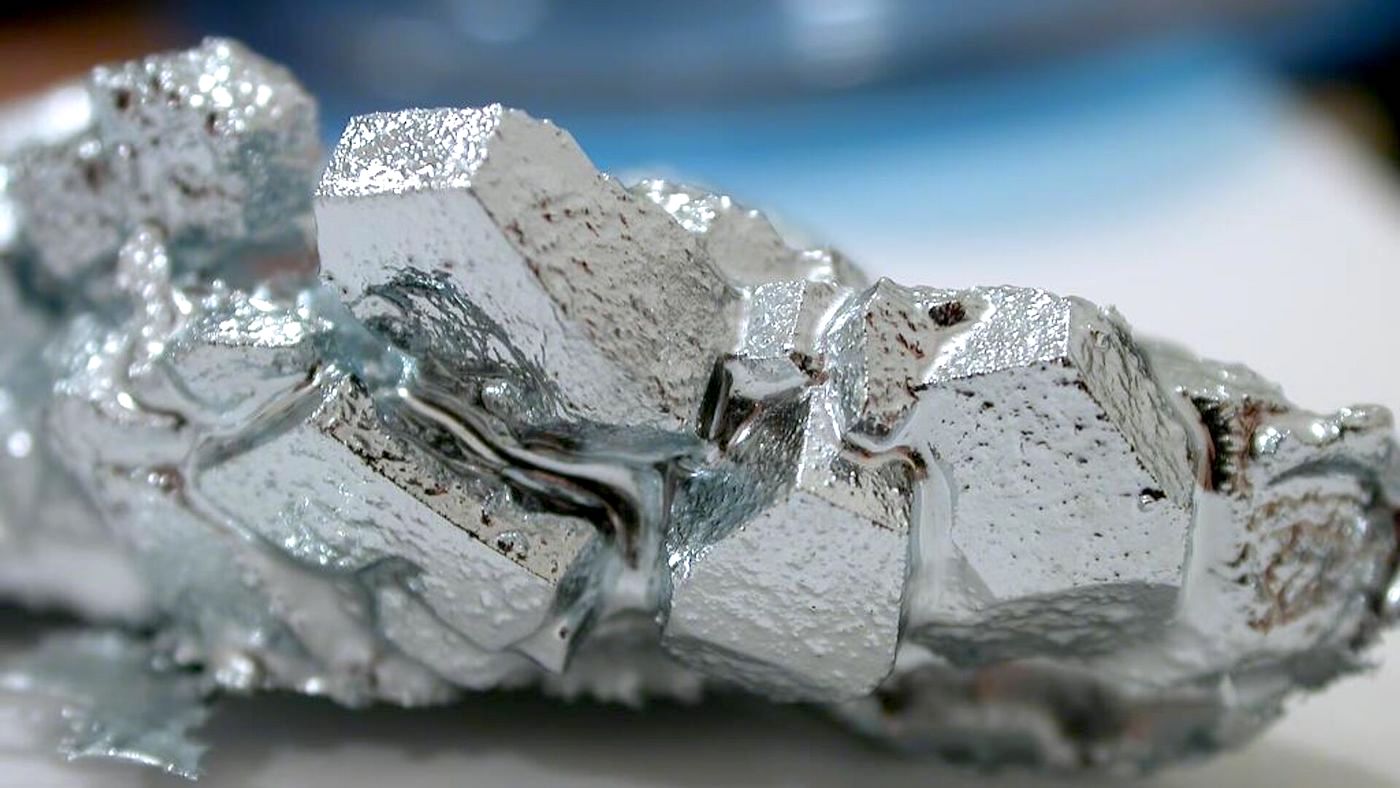

Rio Tinto, working in collaboration with Indium Corporation, has completed the first phase of a research initiative aimed at producing gallium, a rare metal. The companies have successfully produced a pilot batch of gallium, marking a key milestone in the project. The next phase will focus on evaluating the efficiency of extracting gallium from bauxite during the alumina production process. Should this stage prove successful, plans are in place to construct an experimental facility in Quebec, Canada, with a projected capacity of up to 3.5 tonnes of gallium per year. The companies are seeking financial backing from provincial authorities in Quebec for this development.

If the project advances as planned, the final stage will involve establishing full-scale industrial gallium production at the Vaudreuil alumina plant, which is currently the only alumina facility of its kind in Canada and is operated by Rio Tinto. Gallium is primarily obtained as a byproduct during the processing of bauxite and nepheline into alumina, which is then used in aluminium production. It can also be extracted from coal and from water produced during oil and gas extraction. Notably, Altona Rare Earths recently reported finding unusually high concentrations of gallium in fluorite, which is rare for this mineral.

Global gallium production is limited, with only 760 tonnes produced annually. Of this, China is responsible for 750 tonnes, while the remainder comes from Japan, South Korea, and Russia. In Europe, the European Commission has recently designated a project by Greece’s Metlen Energy & Metals to build a 50-tonne-per-year gallium plant as a strategic initiative.

Gallium is used mainly in the manufacture of light-emitting diodes (LEDs) and semiconductors. It also has applications in thermometers as a non-toxic alternative to mercury, as a coolant in nuclear reactors, and in the production of metal adhesives. New uses are emerging, such as in China, where high-power charging stations for electric vehicles have been developed using hollow tubes filled with liquid gallium instead of traditional copper cables, improving heat dissipation during charging. Japanese companies Mazda and Rohm Semiconductor are also developing gallium-based components for electric vehicles, aiming to make them lighter and more compact than silicon-based alternatives. In another development, Australian scientists have created a catalyst from palladium dissolved in liquid gallium, which accelerates chemical reactions by up to 10,000 times. This catalyst could be used for converting carbon dioxide into methanol at low temperatures or for purifying industrial wastewater.

UNCTAD Highlights Risks of Copper Shortage

The United Nations Conference on Trade and Development (UNCTAD) has warned that a looming shortage of copper could slow the rollout of digital technologies and the global shift to green energy. Their forecast suggests that copper demand will rise by more than 40% over the next 15 years. This increase will be driven by the growing production of electric vehicles and solar panels, the expansion of data centers and smart grids, and greater use of copper in water supply systems, where its resistance to bacterial and algal growth is valued.

A major challenge is the decreasing number of large copper deposits being developed, especially those located in favorable geographic and geological regions. The rate of new discoveries is low, and it can take up to 25 years for a new deposit to move from discovery to production. Over half of the world’s proven copper reserves are located in Peru, Chile, Congo, Russia, and Australia. In terms of processing, China dominates, producing 45–50% of the world’s cathode copper and importing up to 60% of copper ore.

Many countries with copper resources primarily export concentrates, missing out on the added value of processing them into cathode copper and manufacturing finished products. UNCTAD has identified the development of copper scrap and waste recycling as a way to help close the supply gap. In 2023, secondary sources contributed 4.5 million tonnes, nearly 20% of global refined copper production. The United States, Germany, and Japan are the largest exporters of copper scrap, while China, Canada, and South Korea are the leading importers.

This outlook is supported by BHP Group, which also forecasts that copper consumption could exceed 50 million tonnes by 2050. However, the pace of new copper mining projects is slow, and it is estimated that an investment of $250 billion will be required to accelerate the development of new deposits. Without this, the copper deficit could reach 10 million tonnes.

United States to Build Its First Nickel Production Plant

Westwin Elements has announced plans to build the first nickel production plant in the United States. The company has secured a $188 million loan from the U.S. Export-Import Bank to support the project. According to the US Geological Survey, global nickel ore production in the past year reached 3.7 million tonnes (pure metal equivalent), with Indonesia leading at 2.2 million tonnes, followed by the Philippines and Canada. The United States produced only 8,000 tonnes, which were exported due to the absence of domestic nickel refining facilities.

Despite strong demand, the US currently imports 100,000 tonnes of primary nickel and 40,000 tonnes of secondary nickel annually, mainly from Canada, Norway, Brazil, and Indonesia. Indonesia has become the world’s largest nickel producer, supplying many countries, including the US.

Westwin Elements plans to build a facility capable of processing 64,000 tonnes of nickel per year. The company will source raw materials from the global market and is also considering the future NorthMet copper-nickel mine in Minnesota as a potential supplier. CEO KaLeigh Long has stated that building the plant will help secure a skilled workforce and avoid deforestation by choosing a non-forested site. The facility will also help the US avoid high import duties and meet rising domestic demand, particularly from stainless steel and heat-resistant alloy manufacturers. Demand for nickel is expected to increase further due to growth in robotics and artificial intelligence.

Emirates Global Aluminium’s Future in Guinea Uncertain

The government of Guinea is considering revoking Emirates Global Aluminium’s mining license due to the company’s failure to meet requirements for building bauxite processing facilities. Under laws adopted in 2022 and 2023, all foreign companies mining bauxite in Guinea must begin local alumina production by 2027.

Guinea Alumina Corporation, majority-owned by Emirates Global Aluminium, began mining operations in 2019 and had reached an annual export volume of 14.1 million tonnes. However, in October 2024, the Guinean government suspended exports following a dispute over customs duties. Guinea produced 144 million tonnes of bauxite in 2024, making it the world’s largest supplier, but only the Friguia alumina plant, operated by Russia’s Rusal, is currently producing alumina in the country, with an output of just under 340,000 tonnes in 2024. In March, China’s SPIC International Investment and Development began constructing another alumina facility.

Guinea’s actions are part of a broader trend in West Africa, where countries such as Mali, Niger, and Burkina Faso are revising agreements with foreign mining companies to increase state revenues and capital investment in local economies. This follows the example set by Indonesia, which banned nickel ore exports and developed its domestic nickel industry.

Cobalt Market Set for Rapid Growth

Indonesia’s cobalt production capacity is expected to reach 114,630 tonnes by 2027, more than doubling the 55,630 tonnes produced last year, according to Septian Hario Seto of Indonesia’s National Economic Council. Indonesia is the world’s second-largest cobalt producer after the Democratic Republic of Congo. Earlier this year, Congo imposed a four-month ban on cobalt exports to support prices, which had fallen due to oversupply. The ban led to a swift increase in cobalt prices. Indonesia, however, does not currently plan to restrict exports.

The increase in Indonesian cobalt output is linked to higher nickel production, driven by the widespread adoption of high-pressure acid leaching technology for laterite ores. According to the Cobalt Institute, demand for cobalt is expected to outpace supply, with the market moving from surplus to deficit by the early 2030s.

Global cobalt supply is projected to grow by about 5% per year, but Congo’s share of the market is expected to fall from 76% in 2024 to 65% in 2030. Indonesia’s share is forecast to rise from 12% to 22% over the same period. Demand for cobalt, excluding government stockpiling, is expected to grow by an average of 7% annually, reaching 400,000 tonnes by the early 2030s. This growth will be driven mainly by the electric vehicle sector. In 2024, global cobalt consumption was 222,000 tonnes, with electric transport accounting for 43% of demand. By 2030, this share is expected to increase to 57%, while demand from other sectors such as electronics and superalloys is expected to slow. The cobalt market had a surplus of 36,000 tonnes in 2024, up from 25,000 tonnes in 2023.