Japan’s Cabinet Office Strategic Innovation Promotion Program (SIP), a government R&D initiative, and research partners have set January 2026 for trial mining of rare-earth-bearing mud on the seabed off Minamitorishima, its easternmost territory, with pilot extraction targeted for the first half of fiscal 2027. The campaign—at around 6,000 meters depth—aims to cut exposure to China amid recurring trade frictions that have disrupted automakers in Japan, the US and Europe. “It’s important to have a supply source ready to operate at any time in case rare earth shipments to Japan are cut off,” says Shoichi Ishii, program director at SIP.

Technology and timeline at 6,000 meters

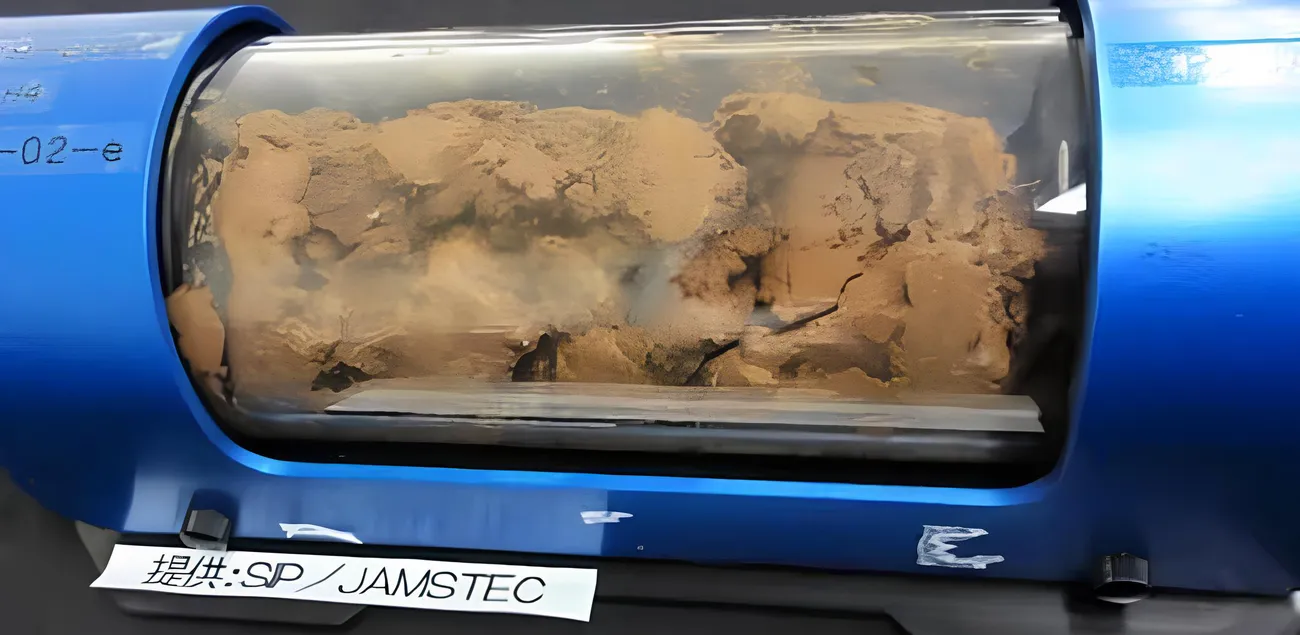

A 6,000-meter riser pipe for lifting mud was delivered at the end of May, and a remotely operated vehicle is scheduled to arrive from Norway in August. The sequence envisages loading both onto a research vessel followed by operational checks ahead of the January 2026 trial. The deposits, first identified in 2012, are contained in fine deep-sea mud thought to be enriched in elements used for high-performance magnets. While some researchers have suggested resource volumes could cover global demand for centuries, SIP characterizes the find more cautiously as “potentially viable for industrial-scale development.” Economic feasibility will be assessed after the pilot program in early FY2027.

Economic feasibility and policy drivers

Interest in rare earths has intensified during the prolonged US–China trade standoff. Beijing has used export controls in past disputes, including tightening measures in April in response to US tariff policy, which temporarily interrupted automotive production outside China. Washington scaled back planned tariff hikes, reinforcing the perception of how leverage over magnet materials can shape industrial outcomes. Japan’s own vulnerability was laid bare in 2010 during the Senkaku incident, when an effective export halt from China rippled through supply chains. “It could happen again at any time,” Ishii warns. Although Japan has diversified more quickly than many Western peers, roughly 60% of its rare earth imports still come from China.

Partnerships, recycling and supply chain diversification

Tokyo and Brussels agreed in July to deepen cooperation on critical raw materials, including potential joint mining and mid-stream processing. On the private side, Nissan and Waseda University are co-developing recycling methods to recover rare earths from end-of-life products, targeting commercialization around 2030. Recycling is seen as a necessary complement to new primary supply given the higher cost and technical challenges of deep-ocean extraction and onshore refining of heavy rare earths. “Some heavy rare earths, scarcer and more valuable than light varieties, can only be mined in China,” notes Professor Kazuto Suzuki of the University of Tokyo. The Minamitorishima mud is thought to be relatively rich in these elements, but “we’ll need to develop the necessary technology to meet these challenges,” Suzuki says.

Company background and market context

SIP is a cross-ministerial program under Japan’s Cabinet Office designed to accelerate pre-commercial technologies with national-level relevance, including resource security. Minamitorishima—an isolated atoll roughly 1,850 km southeast of Tokyo—has appeared in academic literature for its deep-sea mud enriched in rare earth elements, but no industrial-scale extraction has been established. Nissan, a major Japanese automaker, and Waseda University, a leading research institution, are advancing recycling as a parallel route to secure magnet materials. Japan’s approach combines upstream exploration, international partnerships, and circular-economy pathways to reduce single-supplier risk.

China remains the dominant producer and processor across the rare-earth chain. Past export restrictions have periodically constrained supplies of heavy elements such as dysprosium and terbium used to improve magnet performance at higher temperatures. Japan’s import reliance on China—about 60% by volume—has narrowed from earlier levels but remains a strategic concern for sectors including autos, electronics and industrial machinery.