Hunan Zhongke Electric, one of China’s leading lithium-ion battery anode material suppliers, has committed to investing $1.1 billion (8 billion yuan) in a manufacturing facility at Oman’s Sohar Port and Freezone, marking the largest battery materials investment in the Middle East. The project will establish an integrated production base with annual capacity of 200,000 metric tons of lithium-ion battery anode materials, developed across two phases of 100,000 metric tons each, with the first phase scheduled for completion within 36 months.

The investment represents Zhongke Electric’s most ambitious overseas expansion, targeting global supply chain restructuring as electric vehicle demand drives unprecedented growth in battery materials markets. The Chinese company, which shipped 225,700 tons of anode materials in 2024 generating over 5 billion yuan in revenue, supplies major battery manufacturers including Contemporary Amperex Technology, BYD, LG Energy Solution, SK On, and Samsung SDI across domestic and international markets.

Strategic Location Leverages Oman’s Industrial Incentives

Sohar Port and Freezone’s strategic positioning between major markets and comprehensive industrial incentives attracted Zhongke Electric’s investment over alternative locations. The facility will benefit from 100% foreign ownership rights, corporate tax holidays extending up to 25 years, zero import and re-export duties, and zero personal income tax rates. These incentives, combined with Sohar’s proximity to global shipping routes and established industrial infrastructure, provide competitive advantages for serving European, Asian, and African battery markets.

The Oman project enables Zhongke Electric to diversify its geographic footprint while capitalizing on growing international demand for battery materials outside China. The company’s current overseas revenue accounts for only 2.2% of annual income, presenting substantial expansion opportunities as global electric vehicle adoption accelerates and energy storage markets develop.

Sohar Port and Freezone has attracted over $30 billion in total investment, with $4 billion in new projects signed during 2024 alone. The facility joins other major clean energy investments including a $1.35 billion polysilicon production facility, a $1.6 billion LNG bunkering project utilizing solar energy, and wind turbine manufacturing operations by Shanghai Electric Wind Power Group.

Morocco Project Postponement Reflects Strategic Prioritization

Zhongke Electric has postponed construction of its previously announced $694 million anode materials factory in Morocco to focus resources on the larger Oman facility. The Morocco project, designed for 100,000 tons annual capacity at Mohammed VI Tangier Tech industrial city, was initially scheduled to begin construction in 2024 but has been delayed indefinitely as the company prioritizes the Oman investment.

The strategic shift reflects Zhongke Electric’s assessment that Oman offers superior long-term growth prospects and operational advantages compared to North African alternatives. Funding for the Oman project will combine self-owned funds with external financing including bank project loans and potential strategic investors, though the company has not disclosed specific financing arrangements.

The decision underscores intensifying competition among emerging markets to attract Chinese battery industry investment as companies seek to establish global manufacturing networks. Oman’s success in securing the investment demonstrates the effectiveness of its industrial development strategy and competitive positioning within the Gulf region.

Global Battery Materials Market Expansion

The lithium-ion battery anode materials market is experiencing explosive growth, with valuations projected to increase from $12.34 billion in 2025 to $26.33 billion by 2030, representing a compound annual growth rate of 16.17%. Electric vehicle adoption, renewable energy storage deployment, and portable electronics demand are driving unprecedented expansion in battery materials requirements globally.

Anode materials represent a critical component determining battery performance characteristics including energy density, charging speed, cycle life, and safety parameters. Traditional graphite anodes are increasingly supplemented by silicon-enhanced composites and advanced synthetic materials that improve performance while addressing cost and scalability considerations.

Zhongke Electric’s global customer base includes leading battery manufacturers serving automotive, consumer electronics, and energy storage applications. The company’s established relationships with major players including Contemporary Amperex Technology, the world’s largest battery manufacturer, and international suppliers like LG Energy Solution position it to capitalize on continued market expansion.

Regional Clean Energy Hub Development

Oman is positioning itself as a regional hub for clean energy manufacturing and export, with the Zhongke Electric investment complementing broader renewable energy initiatives. The country’s strategic location, abundant solar resources, and government commitment to economic diversification under Oman Vision 2040 have attracted multiple clean energy investments across the value chain.

Recent agreements include JA Solar’s $564 million solar power plant development in northern Oman and Shanghai Electric’s $200 million wind turbine factory in Duqm. These investments, combined with the lithium battery materials facility, create an integrated clean energy manufacturing ecosystem serving regional and global markets.

Chinese investment in Oman has exceeded $6.6 billion, with 76% concentrated in energy and petrochemical sectors. The Zhongke Electric project represents continued Chinese confidence in Oman’s industrial development trajectory and regulatory environment supporting foreign investment in strategic sectors.

Technical Innovation and Production Capabilities

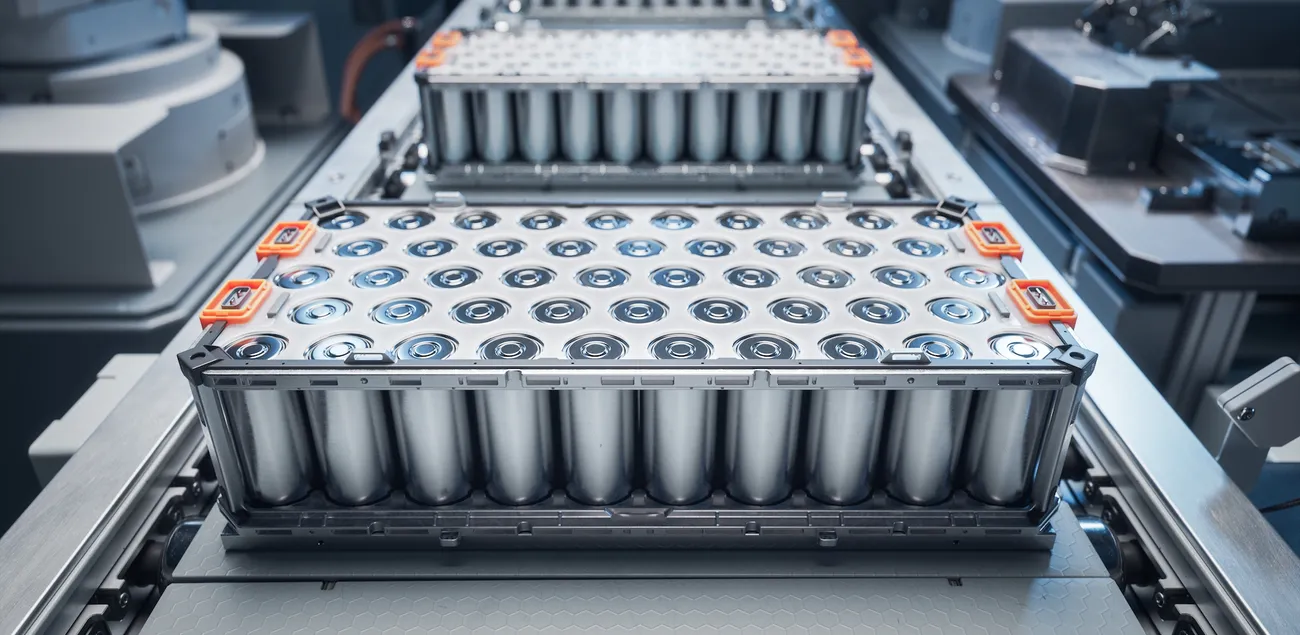

Zhongke Electric specializes in developing, manufacturing, and distributing graphite negative electrode materials for lithium batteries used across consumer electronics, electric vehicles, and energy storage applications. The company’s production capabilities encompass electromagnetic equipment and related products serving diverse industrial applications beyond battery materials.

The Oman facility will incorporate advanced production technologies including chemical vapor deposition, sintering processes, and digital manufacturing systems to optimize yield and quality control. These capabilities enable atomic-level control over coating thickness and uniformity, improving cycle life and safety characteristics essential for automotive and energy storage applications.

Lithium-ion batteries typically endure approximately 2,000 charge-discharge cycles and maintain operational capacity for up to 10 years, significantly exceeding alternative rechargeable battery technologies. The batteries lose minimal charge during storage, approximately 1.5-2% monthly, maintaining capacity over extended periods without use.

Company Background and Market Context

Hunan Zhongke Electric operates as a publicly traded company on the Shenzhen Stock Exchange, specializing in comprehensive electromagnetic metallurgical solutions and lithium-ion battery anode materials. The company has established itself as one of China’s leading anode material suppliers, with 2024 shipments reaching 225,700 tons and revenue exceeding 5 billion yuan. Zhongke Electric serves major battery manufacturers globally while maintaining strong domestic market positions with leading Chinese companies including Contemporary Amperex Technology and BYD.

Sohar Port and Freezone functions as Oman’s largest industrial development zone, managed by Sohar Port Company with over $30 billion in cumulative investment since establishment in 2010. The facility encompasses 4,500 hectares of planned development with 63% completion of the initial 500 hectares, hosting multinational companies across petrochemicals, metals, minerals, food processing, automotive, and logistics sectors. The freezone offers comprehensive industrial incentives and strategic access to Middle Eastern, Indian, and East African markets through integrated port and logistics infrastructure.

The global lithium-ion battery industry continues experiencing unprecedented growth driven by electric vehicle adoption, renewable energy storage requirements, and portable electronics demand. Anode materials represent essential components determining battery performance, safety, and cost characteristics, with market dynamics favoring suppliers capable of delivering advanced materials at scale. Current supply chain restructuring creates opportunities for geographically diversified production networks serving regional markets while reducing transportation costs and supply chain risks.