Global Lithium Market Faces Supply Glut and Weak Demand Heading into 2025

The global lithium market experienced a sharp slowdown in 2024 following years of rapid growth, primarily due to underwhelming electric vehicle (EV) sales outside the Asia-Pacific region. While EV sales in Asia, especially China, remained strong, the Americas saw slowed growth, and Europe faced declining sales, significantly impacting lithium demand.

Simultaneously, a surge in new supply has caused lithium prices to plummet nearly 80% from their peak levels. Producers in Australia and other regions are now grappling with oversupply, prompting only slight production adjustments. China’s lepidolite production, once thought to be a loss leader, halved in the second half of 2024 due to economic pressures. Similarly, high-cost African lithium operations, particularly in Zimbabwe and Nigeria, face production cutbacks amid operational inefficiencies and low prices.

In Australia, only the Greenbushes mine remains profitable. Companies like Mineral Resources and Pilbara Minerals have placed certain operations into care and maintenance to mitigate losses. The industry is also delaying the development of future projects, which could exacerbate supply shortages once demand recovers.

Looking ahead, Adamas Intelligence forecasts a 26% rise in global lithium demand in 2025, reaching 1.46 million tonnes on a lithium carbonate equivalent (LCE) basis. This growth will be driven by China’s EV market, bolstered by economic stimulus and buyer incentives, and expanding energy storage systems, projected to account for 13% of total lithium demand. Additionally, Europe’s stricter CO2 regulations may revive EV sales, and Tesla’s production increase, including a low-cost EV and robotaxi, could further stimulate demand.

On the supply side, lithium output is expected to grow by 16% to 1.58 million tonnes LCE in 2025. Key contributors include Liontown Resources’ Kathleen Valley mine in Australia and Ganfeng’s Goulamina mine in Mali. Brine-sourced lithium projects in South America, particularly in Chile and Argentina, are also poised for expansion, with direct lithium extraction (DLE) technology offering promising efficiencies.

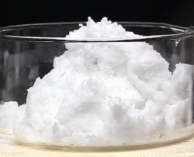

Despite expectations for demand growth, a projected surplus of 115,000 tonnes LCE next year may keep lithium prices subdued. However, if high-cost producers continue cutting back, modest price recovery could follow. Currently, lithium carbonate prices hover around $10-11/kg, with limited upside potential unless significant supply reductions occur.