Glencore, the Anglo-Swiss mining giant led by CEO Gary Nagle, has accelerated its decision timeline for the Mount Isa copper smelter and Townsville refinery to September 2025, warning that multiple Australian processing facilities face imminent closure due to Chinese overcapacity driving treatment charges to record negative levels. The company estimates monthly losses of $30 million...

READ MORE

Western metal smelting operations across copper, zinc, aluminum, and nickel face an unprecedented crisis as Chinese capacity expansion drives treatment charges to historic lows and forces facility closures worldwide. The crisis extends beyond individual company struggles to threaten Western industrial sovereignty, with China approaching the same level of processing dominance in base metals that has...

READ MORE

Glencore, Swiss commodities group, and the Queensland government are locked in urgent talks over the future of the Mount Isa copper smelter and Townsville refinery after Treasurer David Janetzki warned that closure—projected to incur losses of A$2.2 billion (US$1.44 billion) over seven years—would be a “national disgrace.”   Government Standoff Over Smelter Support The...

READ MORE

Rio Tinto, diversified miner, is assessing options for its titanium business after a prolonged price downturn and lower returns, according to people familiar with the process, as Simon Trott, iron ore chief, prepares to take over as chief executive on 25 August. The titanium operation sits in Rio’s Minerals division, which reported underlying EBITDA of...

READ MORE

Rio Tinto, diversified miner, and Aluminium head Jérôme Pécresse will combine the group’s lithium business with aluminium to form a new Aluminium & Lithium product group, as part of a restructuring that leaves three core lines: Aluminium & Lithium, Copper and Iron Ore. The shake-up, unveiled days after Simon Trott became CEO, also moves borates...

READ MORE

Arafura Rare Earths, developer of the Nolans rare earths project in Australia’s Northern Territory, has secured about A$80 million (US$54.4 million) via a two-tranche institutional placement at A$0.19 (US$0.13) a share, issuing roughly 421.1 million new shares, and will open a A$5 million (US$3.4 million) share purchase plan (SPP) on 27 August 2025. If the...

READ MORE

Monash University, a research institution in Melbourne, has unveiled a process to recover all 17 rare earth elements (REEs) from coal fly ash, mine tailings and electronic waste with recovery rates above 90%, positioning waste streams as an immediate feedstock while new mines face long lead times and capital hurdles. The team says coal fly...

READ MORE

Liontown, lithium producer, and the National Reconstruction Fund Corporation, Australia’s state investment vehicle, have agreed an A$50 million ($32.6 million) equity investment to support ramp-up and the transition to underground mining at the Kathleen Valley project in Western Australia. The funding is part of a fully underwritten A$266 million ($173.5 million) placement priced at A$0.73...

READ MORE

Critical Resources, Australian junior explorer, and New Zealand’s minerals regulator have cleared two binding deals that give the ASX-listed company the Cap Burn exploration permit and 90 % of four additional prospecting applications across Otago’s schist belt, positioning the Perth-based group less than 11 km along strike from OceanaGold’s ten-million-ounce Macraes mine and adjacent to...

READ MORE

The Metals Company, deep-sea nodule developer, and Korea Zinc, non-ferrous refiner and TMC investor, have moved the Clarion-Clipperton Zone project up the maturity curve as TMC released a Technical Report Summary of a pre-feasibility study for the NORI-D area and—under SEC S-K 1300—declared ~51 Mt of probable reserves, a first for polymetallic nodules. The package...

READ MORE

Australia, resources exporter, and MP Materials, U.S. rare-earth producer, have moved to formalise price support in critical minerals, with Canberra studying price floors for rare earths and other inputs after Washington guaranteed a $110 per-kg floor for key oxides in a July deal with MP Materials. Shares in Australian names rose Tuesday, including Lynas Rare...

READ MORE

Rio Tinto, one of the world’s largest mining and metals companies, is in advanced negotiations with the Australian federal and New South Wales state governments over a multibillion-dollar bailout package for its Tomago aluminium smelter in New South Wales. The future of the facility—Australia’s largest aluminium producer and single biggest electricity user—has been thrown into...

READ MORE

BHP Group, the world’s largest mining company and biggest iron ore producer, and Rio Tinto, a British-Australian multinational and the world’s second-largest mining company, have experienced share price pressure despite projections of massive demand increases for critical minerals. The International Energy Agency forecasts copper demand will increase 50%, nickel demand will more than double, and...

READ MORE

Rio Tinto has signed a final joint venture agreement with Japan’s Sumitomo Metal Mining (SMM) for the development of the Winu copper and gold project in the Great Sandy Desert, Western Australia. The deal gives SMM a 30% stake in the project for up to $430.4 million. Under the terms, SMM will pay $195 million...

READ MORE

South32 has announced that Chief Executive Officer Graham Kerr will step down in 2026 after over a decade in the role. The company has named Matthew Daley, currently technical and operations director at Anglo American, as his successor. Daley will join South32 as deputy CEO on February 2, 2026, before assuming the top position later...

READ MORE

IGO Ltd has reduced its fiscal 2025 capital expenditure forecast for the Greenbushes lithium mine in Western Australia, now expecting to spend A$700 million to A$800 million (USD $447–$511 million), down from its previous estimate of A$850 million to A$950 million (USD $543–$607 million). The company attributed the cut to a review and optimization of...

READ MORE

Cobalt Blue has entered into a binding agreement with Iwatani Australia to jointly advance development of the Kwinana cobalt refinery in Western Australia. The agreement sets the framework for progressing the project toward a final investment decision (FID) by December 31, 2025. Key conditions to be satisfied before a final decision include verification that cobalt...

READ MORE

Liontown Resources has officially begun underground production at its Kathleen Valley operation in Western Australia, marking a historic milestone as Australia’s first underground lithium mine. The initial blast occurred at the Mt Mann orebody, initiating the transition from open pit to underground mining, which will continue through the 2025–26 financial year (FY26). This development is...

READ MORE

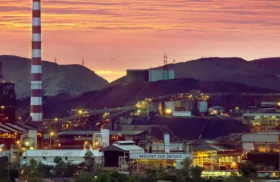

Glencore has confirmed that its Mount Isa copper mine in north-west Queensland will cease production at the end of July 2025, marking the end of over 100 years of continuous operation. The closure, initially announced in October 2023, is attributed to low ore grades and aging infrastructure that render the mine no longer economically viable....

READ MORE

Australian metal producer Aurelia Metals has received approval from New South Wales authorities to triple the volume of ore it can transport from its Federation mine to its Peak processing facility. The change in project consent, announced on March 28, allows the company to move up to 600,000 tonnes of mixed metal ore per year,...

READ MORE

London Metal Exchange (LME) zinc futures climbed nearly 3% last week, closing at $2,972.5 per metric ton, as supply concerns intensified following a planned production cut by Nyrstar, one of the world’s largest zinc smelters. Nyrstar announced it will reduce output at its Hobart zinc smelter in Australia by 25% starting in April 2025. The...

READ MORE

Tennant Mining has commenced commissioning at its Stage 1 Nobles Project gold processing plant, with first gold production moved ahead from the second half of 2025 to June. The near-completion of construction and the finalization of Pan African Resources PLC’s A$77.4 million buyout in December have positioned the company for long-term expansion. Managing Director Peter...

READ MORE

Peter Navarro, former trade adviser to Donald Trump, has accused Australia of undermining the U.S. aluminium market through subsidies and unfair competition. His claims, published in USA Today, have sparked debate, particularly regarding their accuracy and implications for Australia’s trade relationship with the U.S. Navarro alleged that Australia and Canada were launching “frontal assaults” on...

READ MORE

Australia’s largest pure-play lithium producer, Pilbara Minerals, expects demand recovery amid the restart of a major lithium mine and refinery in China, despite posting a net loss for the half-year ending December 31. The company reported a net loss of A$69 million ($44 million) as lithium carbonate prices fell approximately 87% from their 2022 peak...

READ MORE