Palladium (Pd, atomic number 46) lives in the platinum-group family yet refuses to play second fiddle. Lighter than its cousins at 12.0 g cm-³, it also drinks in hydrogen—about 900 ml H₂ per gram at room temperature—forming a spring-loaded palladium-hydride lattice that chemists now exploit for hydrogen-purification membranes. Add a 1 554 °C melting point, a 2 963 °C boiling point, and a 72 W m-¹ K-¹ thermal conductivity that rivals copper, and you have a metal equally at home in micro-electronic contacts and zero-carbon fuel systems.

In trade circles, refiners sell palladium either as sponge (a >99.95% powder used to charge catalysts) or as Good-Delivery ingots certified by the London Platinum & Palladium Market (LPPM). More than four-fifths of primary supply arrives as a by-product of South African PGM-chromite ores or Russian/Canadian Ni-Cu sulfides—a lopsided geology that keeps Pd on the EU, US, and Japanese “strategic mineral” lists.

From Wollaston’s Laboratory to Net-Zero Tool

The saga starts in 1803, when London chemist William Hyde Wollaston teased a new metal out of crude platinum salts and christened it palladium after the recently discovered asteroid Pallas. Early watchmakers loved its bright white hue for springs and gold alloys, but the real plot twist landed in the 1970s, when US Clean Air legislation imposed three-way catalytic converters. Electronics plating rode the 1990s chip boom, and researchers circled back in the 2010s to rediscover Pd’s knack for dense-metal hydrogen membranes. Tight supply, plus China’s 2016–23 emissions blitz, then slingshotted prices from roughly US $500 oz to an all-time high of US $3 433 oz in March 2022.

Production & Supply Dynamics

- Global mine output: World production sagged 9% to 190 t (6.1 Moz) in 2024 as Siberian floods shut haul roads and South African shafts wrestled with rolling blackouts.

- Refined balance: Johnson Matthey’s May 2025 PGM Market Report pegs 2025 primary supply at 6.37 Moz, secondary at 1.39 Moz, against 9.45 Moz demand—a wafer-thin 17 koz surplus after a bruising 501 koz deficit last year.

- Regional mix 2024: Russia 2.75 Moz, South Africa 2.42 Moz, North America 0.81 Moz, Zimbabwe 0.42 Moz.

- Co-production economics: Nornickel keeps Talnakh smelters humming; 2024 Pd guidance is 2.62–2.73 Moz, sanctions noise notwithstanding.

- 2025 outlook: Internal-combustion (ICE) car builds plateau while battery-electric (BEV) share tops 26% (IEA STEPS), trimming autocatalyst loadings -5% y/y. Hydrogen and electronics growth claw back about half that drop, leaving the market wobbling around balance.

Shutterstock

Leading Producer Companies

Major Producers

- MMC Norilsk Nickel (Russia) – Siberia’s titan still rules the Pd roost, drawing metal from the Talnakh and Kola nickel-copper-PGM hubs. After pouring 2.692 Moz in 2023, management guides 2.30–2.45 Moz for 2025 while a critical furnace rebuild winds down. A potential hydrogen-membrane JV with a Chinese partner could open a new downstream chapter.

- Anglo American Platinum (South Africa) – Mogalakwena—today’s largest open-pit PGM mine—plus Amandelbult and Mototolo shafts set up “Amplats” for 3.3–3.7 Moz 6E refined PGMs in FY-2024. The group is wiring in 500 MW of renewables and field-testing hydrogen haul trucks to shave Scope 1 emissions.

- Sibanye-Stillwater (South Africa/USA) – Combining UG2 ounces from Rustenburg and Marikana with Montana’s Stillwater corridor, the company produced 426 koz PGMs (mostly Pd) in 2024. A planned 200 koz cut in US output for 2025 should stem losses amid soft pricing.

- Impala Platinum (South Africa) – “Implats” lifted 1.193 Moz refined palladium from a 3.44 Moz 6E basket in FY-2024 thanks to Impala Rustenburg, Bafokeng, and Lac-des-Îles. The Polokwane furnace rebooted in August 2024, unlocking higher throughput this year.

- Northam Platinum (South Africa) – Zondereinde, Booysendal, and Eland combined for 259 922 oz Pd within an 885 koz 4E suite in FY-2024. An AI-driven concentrator tweak nudged recoveries two percentage points—a seemingly small win that drops straight to EBITDA.

- Zimplats (Zimbabwe) – Ngezi underground plus Selous metallurgy sold 641 koz 6E in FY-2024. A sixth furnace, due Q4 2025, should boost matte capacity ~30%.

- KGHM Polska Miedź (Poland) – Poland’s copper champion squeezed 9.7 koz TPM in Jan 2025 (≈116 koz Pd-eq annualised) from Lubin–Rudna ores. A Głogów tailings pilot now recycles Pd-rich residues back into the circuit.

Mid-sized Players on the Move

- Great Dyke Investments (Zimbabwe) – Darwendale eyes ~430 koz Pd steady state; CMOC term sheet signed for project finance.

- Ivanhoe Mines (South Africa) – Platreef, Phase-1 plant rising; feasibility shows 410 koz Pd pa, sweetened by Ni and Cu credits.

- Generation Mining (Canada) – Marathon, Federal permits landed Feb 2025; PFS maps 112 koz Pd-eq pa over first decade.

- Canada Nickel Company (Canada) – Crawford, 2023 DFS touts ~55 koz Pd-eq as co-product from net-zero nickel autoclaves.

- Tharisa (Zimbabwe) – Karo PGM, Open-pit Phase 1 targets 150 koz PGM 6E (≈ 80 koz Pd); 2025 solar-hybrid MoU promises cheaper, greener power.

Industrial Applications Driving Palladium Demand

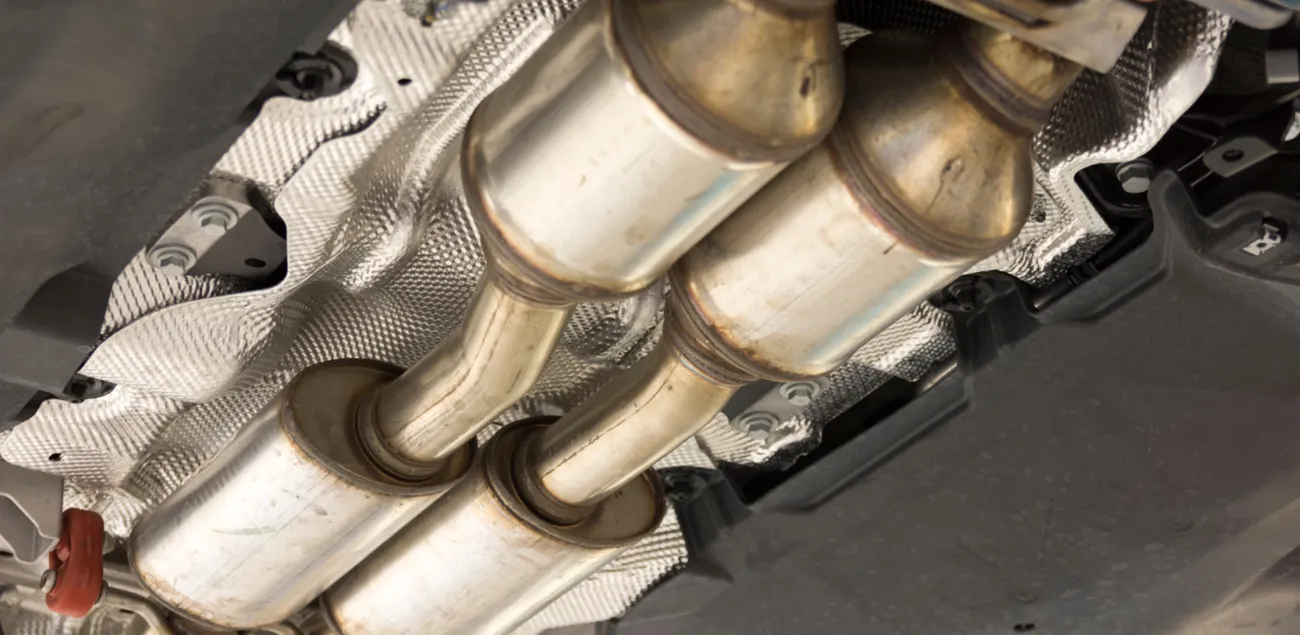

Global palladium demand climbed to ≈ 9.5–9.8 Moz (295–305 t) in 2024, with Johnson Matthey’s flow-of-metal data showing autocatalysts soaking up 82 %—about 7.8 Moz. China’s new CN7 standards, effective July 2025, push average light-duty loadings to ≈ 5 g Pd per vehicle, offsetting a mild dip in North-American SUV sales. Fabricators, however, now treat platinum and palladium as near cost equivalents; OEM testing indicates that up to 25 % of the palladium content in gasoline catalysts can be replaced by platinum without hardware redesign, a swap already underway in Euro 7 calibrations and likely to cap autocatalyst growth at a modest 1–2 % CAGR through 2027.

Beyond tailpipes, electronics accounted for 6 % of 2024 demand (≈ 0.55 Moz). A sustained 35 % price discount to gold spurred a 9 % year-on-year jump in palladium plating for multi-layer ceramic capacitors (MLCCs) and connector pins, especially in the high-frequency boards used by AI accelerators and 5G base stations. Chemical catalysts and nitric-acid mesh gauzes absorbed a further 5 % (≈ 0.45 Moz), broadly flat as adipic-acid plants in Asia throttled back amid weak nylon margins.

The emerging hydrogen economy is the wild card. Dense Pd-Ag membranes consume roughly 350 g Pd per 1 MW H₂-purification skid; scaling the installed base to the mid-range of Nornickel’s forecast—40–50 t (1.3–1.6 Moz) by 2030—would lift palladium’s total industrial pull by nearly 15 %. Investment bars and coins, plus jewellery and dental alloys, together made up ≈ 4 % of 2024 use, but remain price-sensitive and will likely yield metal back to the market if automotive substitution gathers pace. Recycling covers 27–29 % of supply, and tighter EU cat-theft legislation is projected to raise end-of-life recovery another 5 % by 2026, partially cushioning primary-mine deficits even as new hydrogen volumes come onstream.

Shutterstock

Investment Opportunities & Risks

- Upstream equities: Diversified PGM majors yield 6–8% and trade near 0.7× NAV; Norilsk still carries a sanctions discount.

- Recyclers: Heraeus & Umicore forecast 10% CAGR in Pd scrap flows; the Sibanye-Heraeus JV offers a purer play.

- Hydrogen membranes: US start-up RedWave (Series-B US $250 m) touts low-cost Pd foil; Nornickel already owns 15%.

- ETFs/royalties: Aberdeen PALL ETF (0.60% fee); Triple Flag streams Pd from Northparkes at

Risks: Faster BEV uptake (IEA sees >40% car sales by 2030), Pd-to-Pt swapping, a recycling wave, or fresh Russian supply shocks.

Future Outlook

BloombergNEF’s Net-Zero pathway forecasts 615 GW global electrolyser capacity by 2035. That alone could lift Pd-membrane demand to ≈140 koz pa even as autocatalyst consumption dips below 4 Moz. By then, “urban-mine” recycling may cover half of total needs, likely confining prices to a real-terms US $1 000–1 400 oz band—calm only until the next sanctions flare-up or smelter outage.

Policy & Tech Wildcards

- A delayed Euro 7 could swell Pd surplus +300 koz; an accelerated CN8 would hike loadings +7%.

- Commercial methane-to-hydrogen pyrolysis with Pd membranes could burn ~2 t Pd pa by 2032.

- AI-optimised converter recycling aims to raise recovery from 85% to 95%, unlocking ≈400 koz pa.

Palladium’s centre of gravity is drifting from Detroit tailpipes to Shanghai electrolyser halls. Whether Pd morphs into a supply bottleneck or a bridge to net-zero hinges on investors funding closed-loop supply chains and on engineers who perfect substitution and thrifting.

Shutterstock

Frequently Asked Questions (FAQ)

Why is palladium dominant in gasoline autocatalysts, and how does electrification change this?

Fast oxygen-storage kinetics make Pd the king of gasoline converters. Hybrids still need Pd-rich cans, so demand declines gradually as pure BEVs rise.

How does palladium compare with platinum and rhodium in catalytic performance and cost?

Pd activity sits between Pt and Rh. Its volatile price makes the swing metal OEMs tweak each model year.

What is the average palladium loading per light-duty vehicle in 2025?

Roughly 5 g under China’s CN7 rules.

Which countries lead palladium mining and refining, and how could geopolitical risk reshape this?

Russia and South Africa deliver >60% of supply; sanctions or Eskom outages can spike prices within days.

How viable is platinum substitution in autocatalysts at current price ratios?

Up to 25% of Pd can be swapped for Pt without redesign; deeper substitution needs engine re-validation.

Can hydrogen technologies offset declining ICE demand?

Likely. Membranes and selective fuel-cell catalysts could soak up 10–15% of today’s Pd volume by 2030.

What share of supply comes from recycling, and where can it rise by 2030?

About 14% in 2024; Heraeus models >25% by 2030.

How exposed are prices to sanctions on Russian PGMs?

A full ban could tighten supply ~25% and add US $200–300 oz within weeks.

What are the main ESG concerns in underground PGM mining?

Deep-level safety, coal-fired power, and water stress. Miners are rolling out BEV loaders and renewable PPAs to trim CO₂ intensity -30% by 2030.