Lithium is a study in contrasts. It is the lightest structural metal—just 0.534 g cm⁻³—yet the entire electrification push rests on its shoulders. Thanks to a redox potential of –3.04 V, lithium rules the anode roost, squeezing more watt-hours per kilogram than any rival. Physics, in other words, has become geopolitics. Between 2015 and 2024 global demand increased six-fold to roughly 840 kt LCE, and batteries gulped 87 % of that total—up from 23 % a decade ago.

Why does this matter? Supply is concentrated. Australia, Chile and China still provided 74 % of mined lithium in 2024, while China alone refined 70 % of it. Automakers now treat lithium-converter contracts with the same intensity once reserved for silicon chips. Volatility tells the rest of the story: carbonate prices jumped from US $6 400 t in mid-2020 to US $80 000 t in late-2022, only to crash back to US $8 300 t by July 2025—an 89 % peak-to-trough swing that lays bare the stop-start rhythm of the energy transition.

History of Discovery and Use

Swedish chemist Johan August Arfwedson first spotted lithium in petalite in 1817, yet the metal stayed a laboratory bauble for nearly a century. World War II changed that. Lithium-6 became fusion fuel in thermonuclear weapons, while lithium stearate greases kept jet engines humming. By the 1970s lithium-aluminium alloys were trimming weight on NASA’s Space Shuttle.

The real inflection point arrived in 1991 when Sony commercialised the lithium-ion battery, swapping volatile lithium-metal cells for safer intercalation chemistry. Over the next 30 years pack costs fell 97 % and energy density quadrupled, ushering in laptops, smartphones and—finally—electric vehicles. BloombergNEF counts gigafactory capacity rising from 3 GWh in 2010 to 1 100 GWh in 2024, on its way to 4 TWh by 2030.

Global Lithium Production and Supply Dynamics

World mine output hit another record in 2024: 240 000 t Li (≈ 640 000 t LCE), up 18 % year-on-year, says the USGS. Hard-rock spodumene chipped in 62 %, South-American brines 33 %, and clay plus geothermal the rest. Refining is even tighter: China processed 70 % of lithium chemicals in 2024, though that share should slip toward 60 % by 2035 as new plants open in North America and Europe.

Growth is increasingly Made in China. Fastmarkets thinks Chinese mines could overtake Australia’s by 2026, thanks to huge—but low-grade—lepidolite deposits in Jiangxi and Sichuan. Australia, for its part, leans on mid-tier players such as Liontown, Core and Global Lithium Resources, together lining up an extra 70 kt LCE by 2027. In Latin America, Direct Lithium Extraction (DLE) pilots—19 in Argentina alone—aim to tap brines that are too magnesium-rich for classic evaporation.

Conversion capacity is sprinting ahead. Nominal global chemical capacity touched 1.3 Mt LCE yr-¹ in Q2-2025, but depressed prices left utilisation near 55 %. The spare headroom keeps prices tame today yet sows the seeds of a future crunch once demand rebounds.

Shutterstock

Major Producers

- Albemarle – Greenbushes, Wodgina and Chile’s Salar de Atacama shipped ≈ 205 kt LCE in 2024. Kemerton’s third 25 kt hydroxide train fired up in April 2025, and Meishan’s 50 kt converter began commissioning in June, nudging nameplate capacity past 300 kt.

- SQM – The Atacama brine complex moved ≈ 178 kt LCE last year. Plant III debottlenecking lifted output to 210 kt yr-¹; the next 40 kt increment is parked until prices heal.

- Ganfeng Lithium – Chinese lepidolite hubs plus the Cauchari-Olaroz brine produced ≈ 95 kt LCE. A rapid Yichun ramp cut unit costs 12 %, while the Mariana brine targets its first 25 kt in H2-26.

- Tianqi Lithium – Equity stakes in Greenbushes and Kwinana yielded ≈ 85 kt LCE. Kwinana Line 2 passed provisional acceptance in March 2025, taking hydroxide capacity to 48 kt yr-¹.

- CATL – Four Fujian hydroxide lines and the Yichang carbonate plant delivered ≈ 70 kt LCE in 2024, ranking the battery titan fifth among converters. A Sichuan scrap hub adds 25 kt of recycled LCE by 2026.

- Mineral Resources – Mt Marion and 40 % of Wodgina shipped ≈ 83 kt LCE (720 kt spodumene) in 2024; the Onslow JV with Albemarle eyes a 50 kt hydroxide plant for 2027.

- Pilbara Minerals – Pilgangoora pumped out 226 kt dmt spodumene in Q1-25 (≈ 34 kt LCE run-rate). The Calix-backed Pilgariate calciner is due a final-investment decision by Q4-25.

- Arcadium Lithium – Post-merger Livent–Allkem sold ≈ 65 kt LCE in 2024. Sal de Vida Phase 1 (15 kt yr-¹) is on track for first tonnes in H2-25 and points toward 100 kt by 2030.

Mid-sized Players on the Move

- Sigma Lithium – Grota do Cirilo loaded its first cargo in December 2024; Phase 2 will double output to 520 kt dmt (≈ 70 kt LCE) by mid-2026—all on green power.

- Vulcan Energy – Raised €430 m for Europe’s inaugural geothermal-DLE venture; Rhine Valley Phase 1 targets 24 kt hydroxide in 2027 at net-zero Scope 1/2.

- Lithium Americas – Thacker Pass broke ground in March 2024; Stage 1 aims for 40 kt LCE in 2027, pending a DOE loan guarantee.

- Core Lithium – Finniss ramped to 350 kt dmt in 2024, shooting for 500 kt steady-state and scoping a 30 kt hydroxide JV at Darwin by 2028.

- ioneer – Rhyolite Ridge clinched a conditional DOE loan; a 22 kt boric-acid co-product keeps projected lithium costs under US $4 000 t once first LCE lands in 2026.

- Jiangxi Jinli High-Tech – Recycled 18 kt LCE from black mass in 2024; a second 30 kt closed-loop plant, backed by CATL offtake, comes online in 2026.

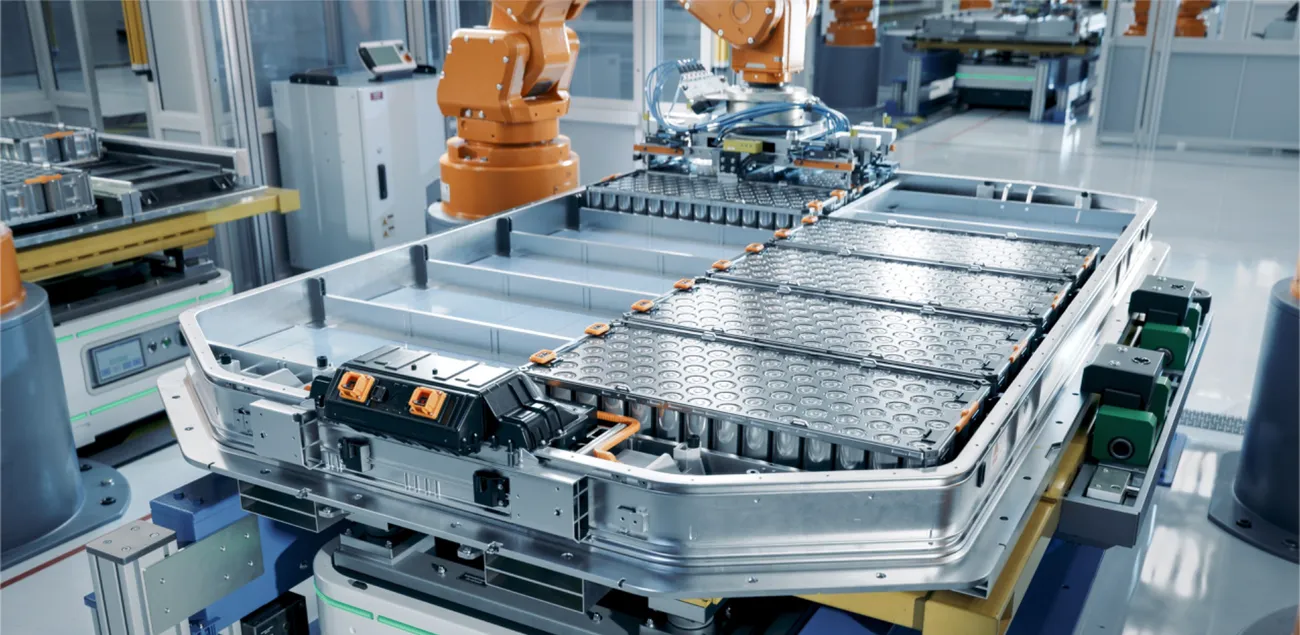

Industrial Applications Driving Lithium Demand

Batteries hog the headlines—but not the whole pie. In 2024 they consumed an estimated 730 kt LCE:

- 55 % into EVs

- 21 % into consumer electronics

- 11 % into stationary storage, the fastest-growing slice

The IEA’s Net-Zero pathway calls for ≈ 970 GW (≈ 1 500 GWh) of cumulative storage by 2030—a 35-fold jump on 2022. BNEF models 1 143 GWh of additions between 2022 and 2030.

Chemistry shapes lithium form. Entry-level EVs and grid packs lean on LFP, which drinks lithium carbonate. Premium cars favour high-nickel NCM/NCA cathodes that rely on hydroxide, now trading at a 20 % premium to carbonate. Pack-level lithium intensity sits near 8 kg per 60 kWh, but silicon-rich and lithium-metal anodes in the lab could push past 10 kg per vehicle.

Off-battery demand is steady: ceramics and glass claim 5 %, greases 3 %, with air-treatment, pharma and aluminium alloys mopping up the balance. Yet batteries are the swing factor—each percentage-point rise in global EV penetration adds roughly 70 kt LCE, the output of a mid-tier mine.

Shutterstock

Lithium Market Analysis and Price Trends

The super-cycle hangover continues. USGS puts average contract carbonate at US $14 000 t for 2024, down 62 % YoY. As of 16 July 2025 Fastmarkets quotes battery-grade carbonate CIF Asia at US $8 300 t and hydroxide DDP US at US $10 300 t. ICE futures hint at a gentle rebound: Q1-2026 carbonate last settled at US $9 000 t.

Supply/demand maths remains tight: Fastmarkets pegs 1.44 Mt LCE capacity versus 1.39 Mt demand in 2025—a wafer-thin 50 kt surplus. Chinese port stocks are chunky, but April-2025 conversion run-rates were 19 % lower year-on-year, implying curtailments could set a floor. Spodumene spot slipped below US $900 dmt in June 2025, squeezing high-strip Australian pits.

Risk-management tools are maturing. Fastmarkets and ICE launched cash-settled futures in May 2025; open interest hit 3 900 t LCE equivalent within six weeks—tiny beside copper, but already triple the LME’s short-lived 2019 lithium contract.

Investment Opportunities in Lithium

Equity investors took their lumps in 2024: the Solactive Global Lithium Index sank 38 %. Integrated chemical houses such as Ganfeng held up, cushioned by captive spodumene, while single-asset miners halved. Lesson learned: control the conversion step, not just the orebody.

Venture cash keeps flowing to big-swing bets. PitchBook logged US $2 bn for DLE start-ups in 2024—headlined by Lilac’s US $340 m Series D and Standard Lithium’s US $500 m ExxonMobil tie-up in Arkansas. Battery recyclers raised another US $1.1 bn; Ascend-Elemental’s Polish plant, opened September 2024, can treat 12 kt of spent cells a year—28 000 EV packs.

Policy sweetens the risk-reward. The US IRA offers a 10 % manufacturing credit on domestic lithium chemicals; the EU Critical Raw Materials Act mandates ≥ 15 % recycled lithium in new batteries from 2031. Washington’s April-2025 guidance confirmed that brine-to-chemical projects in FTA nations qualify for EV tax credits—a boon for Chile and Argentina.

Future Outlook

The IEA’s 2025 Critical Minerals Outlook foresees 1.1 Mt LCE of mine supply by 2030 under current policies—just shy of the 1.2 Mt demand base-case, and 400 kt short under its Net-Zero scenario. Three levers matter:

- Brown- and green-field builds – Kemerton 3 and Atacama V add 100 kt hydroxide by 2027. Australia still has nine shovel-ready spodumene mines awaiting offtakes.

- Technology gains – DLE pilots in Qinghai, Argentina and the US Smackover aim for costs below US $4 000 t by recycling >90 % of brine water.

- Circularity – Announced recycling plants could process batteries containing ≈ 220 kt LCE by 2030—enough to offset more than one medium-size mine.

Substitution will chip around the edges. Sodium-ion promises cheap storage for scooters and grid buffers, but its energy density (100–160 Wh kg-¹) trails LFP’s 170–220 Wh kg-¹, limiting long-range uses. Solid-state chemistries, ironically, would need more lithium in metal-anode form.

Regulation could prove the tightest choke point. Chile’s new royalty, talk of an Australian “super-profit” tax, and China’s licence rules for lithium technology all underscore how fragile a global supply chain can be. Diversification, water-smart brine projects and aggressive recycling are no longer nice-to-haves—they’re survival tactics ahead of the next price spike.

Shutterstock

Frequently Asked Questions (FAQ)

Why is lithium so vital for modern batteries?

Its tiny ionic radius and single-electron valence deliver unbeatable energy density and quick charge cycles.

Carbonate vs. hydroxide—what’s the difference?

Carbonate feeds LFP cathodes for mass-market EVs; hydroxide suits nickel-rich cathodes that chase higher energy density.

Who produces the bulk of lithium today?

Australia, Chile and China dominate. Hard rock supplies ≈ 60 %, brine ≈ 35 %, with clay and geothermal filling the rest.

Which companies are expanding fastest?

Albemarle, SQM, Ganfeng and Tianqi still control about half the market, but Pilbara Minerals, Arcadium Lithium and Vulcan Energy sport the steepest growth curves.

What is Direct Lithium Extraction (DLE)?

It uses sorbents or membranes to pull lithium from brine in hours, recycling most water. Commercial volumes are expected later this decade.

How much lithium sits in an average EV battery?

Roughly 8 kg today, trending toward 6 kg by 2030 as pack efficiency rises.

Are today’s low prices a threat to supply security?

They can shutter high-cost mines, yes—but low prices also spur demand and boost recycling, setting up the next squeeze.

Can sodium-ion replace lithium outright?

Not for long-range cars or high-power storage; lithium’s energy punch still wins this decade.

How recyclable is lithium now, and by 2030?

Current recovery hovers around 40 %. Planned plants could lift capacity to handle spent cells containing ≈ 220 kt LCE by 2030.