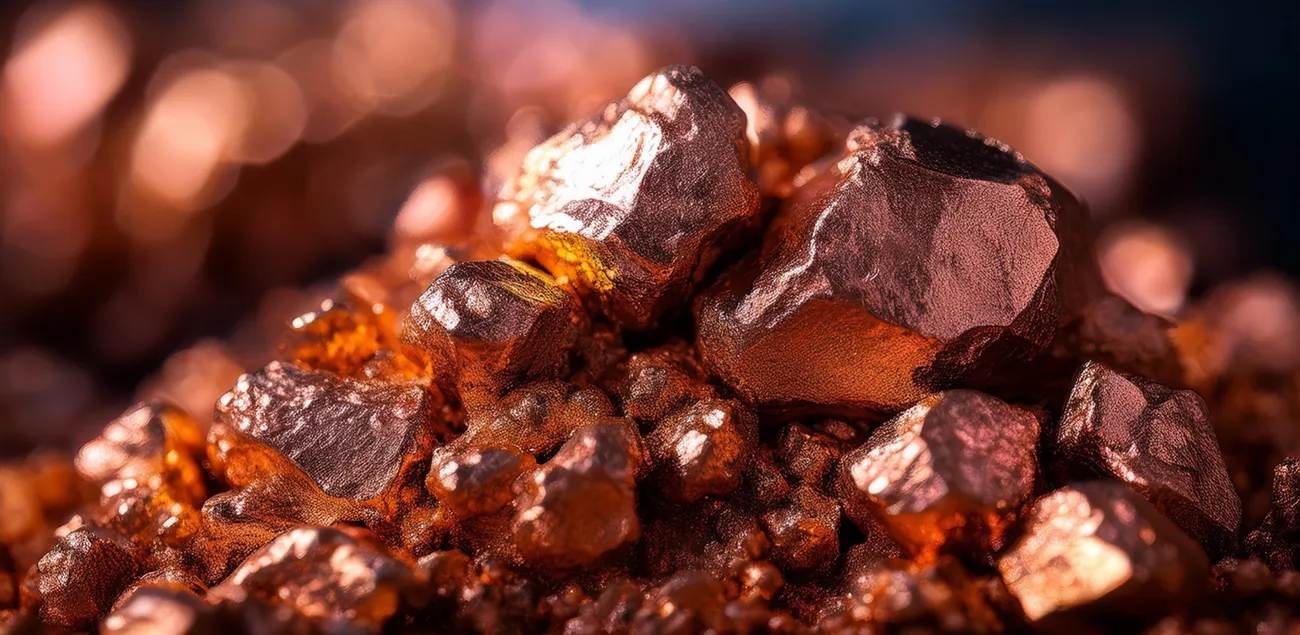

Copper is the quiet superstar of the periodic table. Element 29 sits in the transition-metal block, glinting reddish-gold in its pure state and remaining astonishingly versatile in an era of gigawatts and gigabytes. With a density of 8.96 g cm⁻³ and a melting point of 1 085 °C, it marries top-tier electrical and thermal conductivity with a self-protecting, corrosion-resistant patina. Hospitals prize its antimicrobial action, and grid engineers cherish its ductility, which lets conductors wrap around tight radii without metal fatigue. Roughly 80% of all copper ever mined is still in circulation, underscoring both its durability and the metal’s enviable recyclability. No wonder insiders call it the “metal of electrification”: power grids, EV drivetrains, renewables, AI data-centres and modern defence systems all run on copper metal — and lots of it.

History of Discovery and Use

Archaeologists date humanity’s first flirtation with copper to ≈ 9 000 BC at Çatalhöyük in Anatolia, where naturally occurring nuggets were cold-hammered into beads. Metallurgy’s next leap came circa 3 300 BC when smiths discovered that alloying a dash of tin or arsenic produced bronze hard enough for weapons and plough-shares. Cyprus (cuprum) gave the element its Latin name and, along with Egypt’s Sinai and Spain’s Riotinto mines, fed the Roman Empire’s plumbing and coinage.

Victorian inventors then set copper demand on a steeper trajectory. Morse’s telegraph and Bell’s telephone wrapped continents in wire, Edison’s dynamos spun electricity into being, and by the 20 th century copper metal underpinned HVAC, printed-circuit boards and national wiring codes. In the digital era, USB-C cables, smartphone logic boards and gigawatt-scale transformers prove that a 10 000-year romance shows no sign of cooling.

Global Copper Production and Supply Dynamics

World mine output reached roughly 23 million tonnes (Mt) in 2024 and is edging toward 23.5 Mt in 2025. Country shares remain concentrated: Chile ≈ 23%, DR Congo 14%, Peru 11%, China 8%, United States 5%.

Yet geology and geopolitics are eroding complacency. Chile’s average ore grade has slipped below 0.5% Cu, forcing multi-billion-dollar desalination plants to keep concentrators wet. In Peru, community blockades along the Southern Corridor periodically strand trucks carrying 3% of global tonnage. DR Congo’s booming Copperbelt wrestles with grid bottlenecks and royalty disputes. Meanwhile Washington’s proposed 50% U.S. tariff on refined copper, slated for early August 2025, is already rerouting metal and deepening the squeeze on concentrates despite new volumes from Anglo American’s Quellaveco and Ivanhoe-Zijin’s Kamoa-Kakula expansions.

On paper the refined market shows a 301 kt surplus for 2024 and ≈ 285 kt for 2025. In practice, those buffers are wafer-thin: European smelters complain of tight scrap, while China sits on swelling bonded stocks. As one trader quips, “the balance is perched on the head of a pin.”

Shutterstock

Leading Producer Companies

Major Producers

- BHP (Chile/Australia) – Escondida, Spence and Olympic Dam together turned out about 1.36 Mt of copper in 2024. A new desalination plant at Spence secures water, and de-bottlenecking at Escondida could unlock another 150 kt per year by 2027.

- Codelco (Chile) – Despite fading head grades, the Chilean giant still delivered ≈ 1.43 Mt in 2024. Its US $40 bn suite of underground transitions at Chuquicamata, El Teniente and Andesita aims to push output back above 1.6 Mt pa by 2028.

- Freeport-McMoRan (USA/Peru/Indonesia) – Morenci, Cerro Verde and the fast-ramping Grasberg Block Cave produced ≈ 1.26 Mt. A 1.7 Mt pa Gresik smelter starts up in H1-25, letting Freeport keep the downstream margin in-house.

- Glencore (Peru/Chile/Democratic Republic of Congo) – Antapaccay, the Collahuasi JV and Katanga combined for ≈ 0.95 Mt last year; a cobalt-circuit upgrade at Katanga should free up 40 kt more copper by 2026.

- Southern Copper (Peru/Mexico) – Buenavista plus Toquepala yielded ≈ 0.88 Mt. The 120 kt pa Tía María project is shovel-ready once it secures a final social licence.

- Anglo American (Peru/Chile) – Quellaveco’s ramp-up and steady output at Los Bronces lifted group production to ≈ 0.77 Mt. The Los Bronces Integrated Project extends mine life beyond 2036 and halves freshwater use via desalinated supply.

- First Quantum Minerals (Zambia/Panama) – Kansanshi’s S3 push kept the group near 0.75 Mt despite Cobre Panamá’s suspension; arbitration proceeds in parallel with restart contingency work.

- Zijin Mining (Serbia/Democratic Republic of Congo) – Timok Phase 1 and a 39.6% share of Kamoa-Kakula produced ≈ 0.68 Mt. A 500 kt pa smelter at Kamoa comes online in 2025, ending long-haul concentrate trucking.

Mid-sized Players on the Move

- Lundin Mining (Argentina/Chile/Brazil) – The Josemaria build will lift capacity toward ≈ 370 kt pa by 2027, complementing Candelaria and Chapada.

- Antofagasta (Chile) – Logged ≈ 664 kt in 2024; desalination and debottlenecking at Los Pelambres should nudge output past 700 kt pa from 2026.

- Ivanhoe Mines (Democratic Republic of Congo) – Its share of Kamoa-Kakula reached ≈ 397 kt; a 500 kt pa blister-copper smelter is slated for Q4-25, halving logistics costs and Scope 3 emissions.

- Capstone Copper (Chile/Mexico) – The Mantoverde–Santo Domingo hub will double Chilean tonnage and push group output beyond 350 kt pa by 2028 on 100% renewable power.

- Hudbay Minerals (USA/Canada/Peru) – Copper World (Arizona) targets ≈ 100 kt pa in Phase 1 once permits land; a sulphide-leach pilot is moving to DFS stage.

- Ero Copper (Brazil) – The Tucumã start-up plus Caraíba bio-leach trials position the group for ≈ 130 kt in 2026 while trimming cash costs via bacterial heap oxidation.

- Sandfire Resources (Botswana) – Motheo produced first concentrate in 2023; expansion trains point to >100 kt pa by 2027, supported by a 43 MW solar-hybrid plant that cuts diesel use 30%.

Industrial Applications Driving Copper Demand

Refined-copper use hit ≈ 28 Mt in 2024, up 3% year-on-year, with scrap covering about 34% (≈ 9.5 Mt). Growth comes from the “electron economy.”

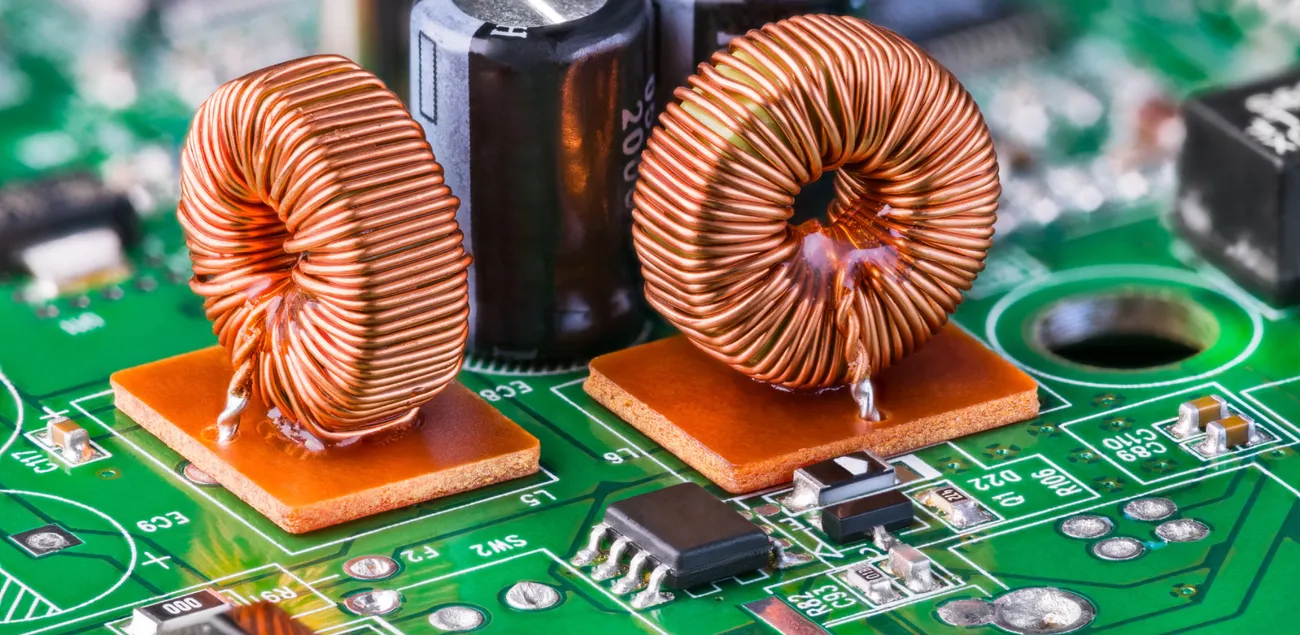

Electrical & electronics led at ≈ 36% (about 10 Mt). Everything from household wiring to busbars in hyperscale AI clusters—now drawing 70 MW or more per hall—depends on copper. A single server rack uses over 15 kg, especially with thicker liquid-cooling plates.

Building construction held ≈ 30% (≈ 8.4 Mt). HVAC tubing, earthing systems and antimicrobial roofing remain staples, while tougher energy codes are swapping steel for copper in heat-pump loops—adding roughly 120 kt last year.

Transport absorbed ≈ 12% (≈ 3.3 Mt) but is changing fastest. Battery-electric cars average 80–85 kg of copper—almost triple an ICE vehicle—pushing auto demand up by nearly 400 kt in 2024 despite some aluminium substitution in entry models. Aviation and shipbuilding add niche pull, with next-gen naval vessels specifying all-copper piping for fire safety.

Industrial machinery and thermal kit took ≈ 13% (3.6 Mt). Copper’s conductivity underpins everything from heat exchangers to injection-mould inserts. Renewables deepen the load: offshore wind needs about 8 t per MW, and utility-scale battery farms 1–2 t per MWh. Last year’s 18 GW of new offshore wind alone added roughly 140 kt of demand.

Substitution stayed modest: aluminium wiring clawed back just 35 kt worldwide in 2024, and graphene-coated alternatives remain lab curiosities. On the supply side, China’s upgraded scrap-sorting rules unlocked another 0.4 Mt of high-grade secondary metal, while Europe’s Critical Raw Materials Act is set to favour low-carbon, recycled copper in public tenders by 2027.

With legacy mines aging and electrification accelerating, copper’s trajectory remains steep—on track for a 33–34 Mt globally by 2030 unless a wave of new supply breaks first.

Shutterstock

Copper Market Analysis and Price Trends

The LME cash price fixed at US$ 9 555 /t on 14 July 2025 (~US$ 4.33 /lb), down from the March high above US$ 10 500 /t yet still a quarter above the five-year average. Comex briefly touched US$ 5.68 /lb on tariff angst, creating a record arbitrage over LME cash and draining LME sheds to ≈ 110 kt, a ten-year seasonal low. Volatility has been intense, with ±15% swings through Q2–Q3 as algorithmic trading amplifies policy risk. Another wild card is the AI hardware boom: Taiwanese fabricators report copper-foil demand for high-density PCBs up 18% year-on-year, nudging premiums for nine-micron cathode.

Key drivers are converging: first, energy-transition demand continues to outpace mine approvals; second, tariff uncertainty reroutes trade flows and creates regional shortages; third, currency moves (notably a stronger dollar) skew pricing, while SHFE–Comex arbitrage reshuffles metal east-west; and finally, rising policy premiums for traceable, low-carbon copper deter substitution and reward certified producers. J.P. Morgan still targets US$ 10 400 /t in H2-2025 and US$ 11 000 /t in 2026 on a projected 160 kt refined deficit.

Investment Opportunities in Copper

UN scenarios point to > 40% incremental copper demand by 2040, implying ≈ 80 new mines and US$ 250 bn in greenfield capex this decade. Western incentives for low-carbon smelting have birthed a fledgling “green-premium” market worth up to US$ 90 /t. Financial exposure comes in several flavours: exchange-traded futures on LME or Comex offer pure price leverage, physically backed copper ETFs let investors hold warehouse-stored metal, royalty and streaming vehicles collect slices of mine revenue without operating risk, and high-grade scrap recyclers deliver equity-style upside while insulating investors from mine-development hazards. Downside risks range from tariff wars that squeeze regional premia, through a potential China construction slowdown, to material substitution and the ever-present threat of ESG-driven permitting delays.

Future Outlook

ICSG’s mild surplus tempers near-term exuberance, yet Wood Mackenzie and S&P Global warn of > 6 Mt cumulative deficits by 2030 if project slippage continues. Technology could shift the calculus: coarse-particle flotation halves milling energy, biomining taps low-grade ores, seawater pipelines keep Atacama concentrators hydrated, and direct-to-wire-rod 3-D printing blurs smelter–fabricator lines. Recycling’s share is forecast to jump from ≈ 35% to > 45% by 2030, softening but not erasing the call for primary mines. Absent a run of giant discoveries, the long-run price bias tilts upward as under-investment meets electrification’s megatrend.

Shutterstock

Frequently Asked Questions (FAQ)

Why is copper considered the foundation metal of electrification?

Because no other affordable material matches its twin virtues of high electrical conductivity and durability, making it irreplaceable from transformers to smartphone ports.

Where is copper mined and refined globally?

Mining clusters in Chile, Peru and the DR Congo, while smelting capacity concentrates in China, Chile, Japan and Germany.

Which companies dominate copper production in 2025?

BHP, Codelco, Freeport-McMoRan, Glencore, Southern Copper, Anglo American, First Quantum and Zijin.

How much copper does an electric vehicle use versus a conventional car?

A typical battery EV contains ≈ 80 kg Cu, nearly triple the ≈ 30 kg in a gasoline car.

What drives copper prices in 2025?

Tariff uncertainty, tight LME warehouse stocks, currency swings and relentless electrification demand.

Is recycled copper equivalent in performance to primary metal?

Yes. Refinery-grade scrap yields cathode identical to primary copper metal, making recycled copper a cornerstone of future supply.

What environmental or community challenges face new copper mines?

Water scarcity, tailings safety, Indigenous land rights and Scope 3 carbon footprints can delay approvals.

How can investors gain exposure to copper?

Via futures, copper metal ETFs, mining equities, royalty/streaming contracts or specialist recyclers — each with distinct risk-return profiles.